Leader of Sustainable Finance and Climate Advocacies in Asia

Cathay Financial Holdings is a leader in driving Taiwan towards a future of net-zero emissions.

Climate risks have been deemed as the most pressing agenda in the “Global Risks Report” released by the World Economic Forum (WEF) in the last five years. Cathay has been committed to international sustainable finance, responsible investment and climate actions over the years, in addition to supporting multiple international advocacies. Apart from valuing the operation sustainability transition, Cathay is also one of the most active and leading financial enterprises in Asia in corporate engagement.

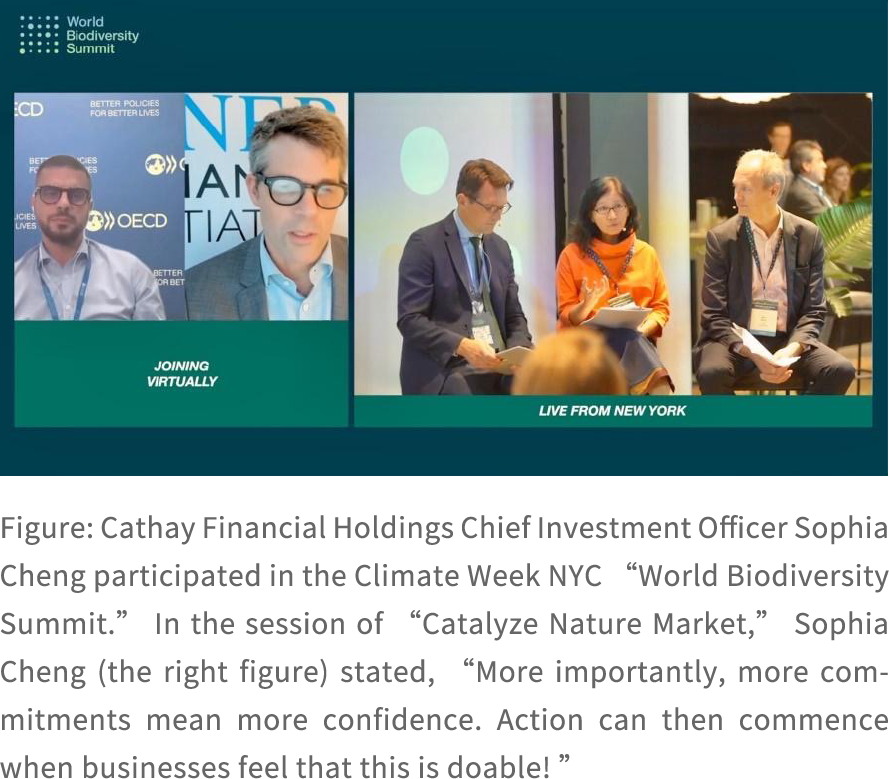

Cathay actively bridges connections in the world as the first financial industry company in Taiwan to join the U.N. General Assembly climate change conference. After being the only representative from Taiwan financial industry attending the COP26 Conference, Chief Investment Officer Sophia Cheng was the only invited speaker from Taiwan to talk to international leaders of all sectors during the 77th Session of the United Nations General Assembly (UNGA 77) and Climate Week NYC on September 21, 2022. Sophia Cheng shared viewpoints of sustainable finance on behalf of Taiwan and the experience of Cathay’s success story in promoting corporate engagement in Asia. Cheng elaborated on the utilization of a foundation built on corporate sustainability in Asia to expand advocacy work to biodiversity.

Cathay Financial Holdings, the first financial institution in Taiwan to join RE100, committing to 100 percent renewable energy across its global operations by 2050.

Cathay Financial Holdings announced in June 2021 that it will follow the guidelines of the RE100 global renewable energy initiative and became the first RE100 member in Taiwan’s financial industry in April 2022. By implementing renewable energy plans, zero-coal plans, and fossil fuel investment, Cathay has pledged that all global locations of the group will use only renewable energy by 2050, so as to realize the goal of net-zero carbon emissions.

Furthering its efforts toward green energy goals, Cathay Financial Holdings has continued to invest in renewable energy in addition to purchasing renewable energy certificates (RECs) and entering into power purchase agreements (PPA). This move can affect the development of renewable energy-related industries, in addition to the sustainable innovation of their own enterprises, can also stimulate greater changes in the future. In order to implement the company goals, Cathay Financial Holdings President Chang-Ken Lee also linked his personal annual goals with carbon reduction results. Mr. Lee’s determination is fully supported by its subsidiary companies.

Industry leader investing in the development of renewable energy industries

Cathay Financial Holdings has made efforts in investment and financing in line with RE 100 principles. Since 2014, Cathay Financial Holdings has been supporting renewable energy industries, green debts, and supporting green enterprises. The subsidiaries are also committed to promoting green financing through core competency.

First, in “support of renewable energy industries,” Cathay Life Insurance has been connecting companies like AU Optronics, Sino-American Silicon Products, Neo Solar Power, and Solar Master Energy, with solar energy service providers for joint investment opportunities since 2014. Cathay also launched a low-carbon investment and credit loan in the “renewable energy” category in the amount of NT$40.7 billion in 2020.

Since 2011, Cathay United Bank has built a pioneering power plant evaluation model to provide guidelines for relevant financing assessments, which has become one of the largest financing banks for solar power plants. At the end of 2021, Cathay United Bank had financed over 2,500 domestic and foreign solar power plants, with a total installed capacity of 758MW, reducing CO2 emissions by nearly 393,000 metric tons.

For the “development of green insurance/products,” Cathay Insurance provides construction insurance for the renewable energy industry. Since 2010, Cathay Century, Cathay’s P&C-focused subsidiary, has provided construction insurance for hydroelectric power plants, solar power generation equipment, and offshore wind power projects. As of 2021, Cathay Century’s coverage in the renewable energy sector was valued at NT$148.8 billion. In 2020, the Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF, issued by Cathay SITE, was launched, setting records in the Taiwan stock market for the highest IPO value ever attained. It is the first ETF in Taiwan to combine ESG and high dividends, and also the first Taiwan stock ETF to adopt “quarterly distribution” dividends. By the end of 2021, the ETF had reached NT$35 billion in AUM.

As the strategic partner of World Climate Foundation, Cathay has taken the initiative to feature live streaming of the World Climate Summit (WCS) of 2022 United Nations Climate Change Conference (COP27) held in Egypt at the Cathay Sustainable Finance and Climate Change Summit held on 11/13-11/14. It is the first time for Taiwan to synchronize with the COP summit. Cathay leads Taiwan’s financial industry to focus on sustainable finance and climate change related issues, bringing Taiwan companies forward in the global sustainability wave.